How I Hit 83% Win Rate in One Day (10x Faster Backtesting)

If you feel your backtesting efforts are too slow, I may have a 10x booster for you.

Photo by Ian Taylor on Unsplash

Photo by Ian Taylor on Unsplash

I did 70 backtests in one day (8 hours). That's about 7 minutes per thoughtful backtest. And it is at least 10x faster than before.

Hear the single-day journey from a simple idea in my head to strategy that gives over 80% win rate.

The Seed

We always start with a first idea. We test it and then improve.

I started with APPL. Took the last 6 years of daily data.

My hypothesis: if a ticker is falling but slowing down, it'll bounce back.

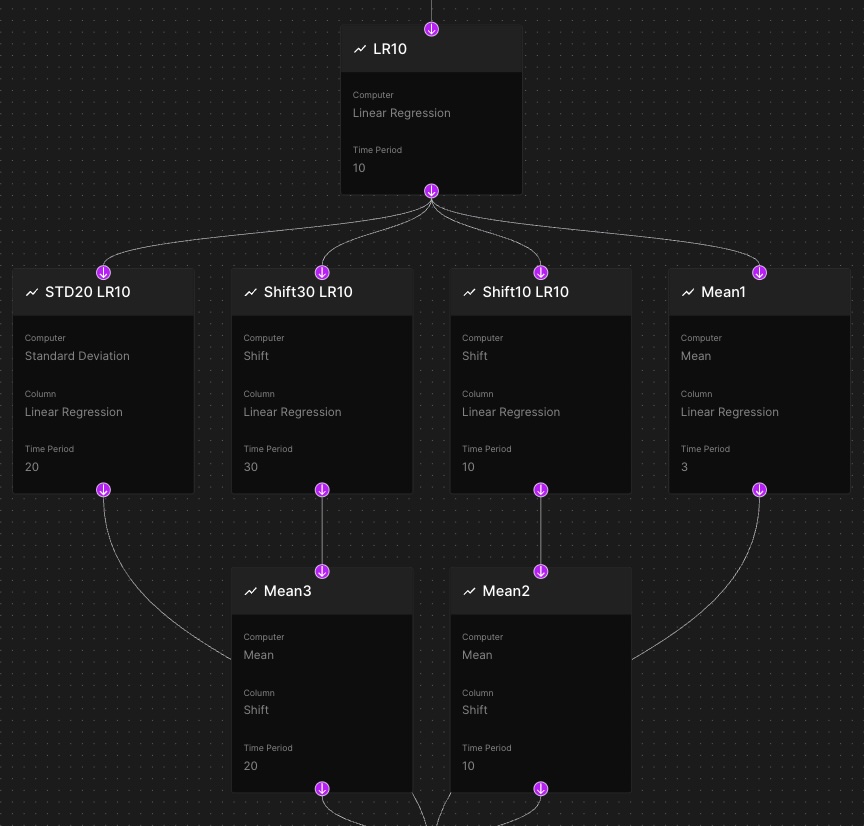

No existing indicator shows this, so I built my own based on mean values of a linear regression.

Doesn't sound scientific? Maybe that's good. Simple linear models and common sense might still work for retail traders.

My first indicator version has shown -1.5% ROI/ 26% win rate.

Sucked, and my indicator was catching the pattern accurately in 30% of cases.

Capturing the Right Thing

I'm not a math genius, but I will always remember my grandma saying: patience and hard work can overcome everything.

I iterated changing my indicator logic, and checked what it captures.

After a few hours, my indicator started to find what I wanted it to find: AAPL failing, then slowing down.

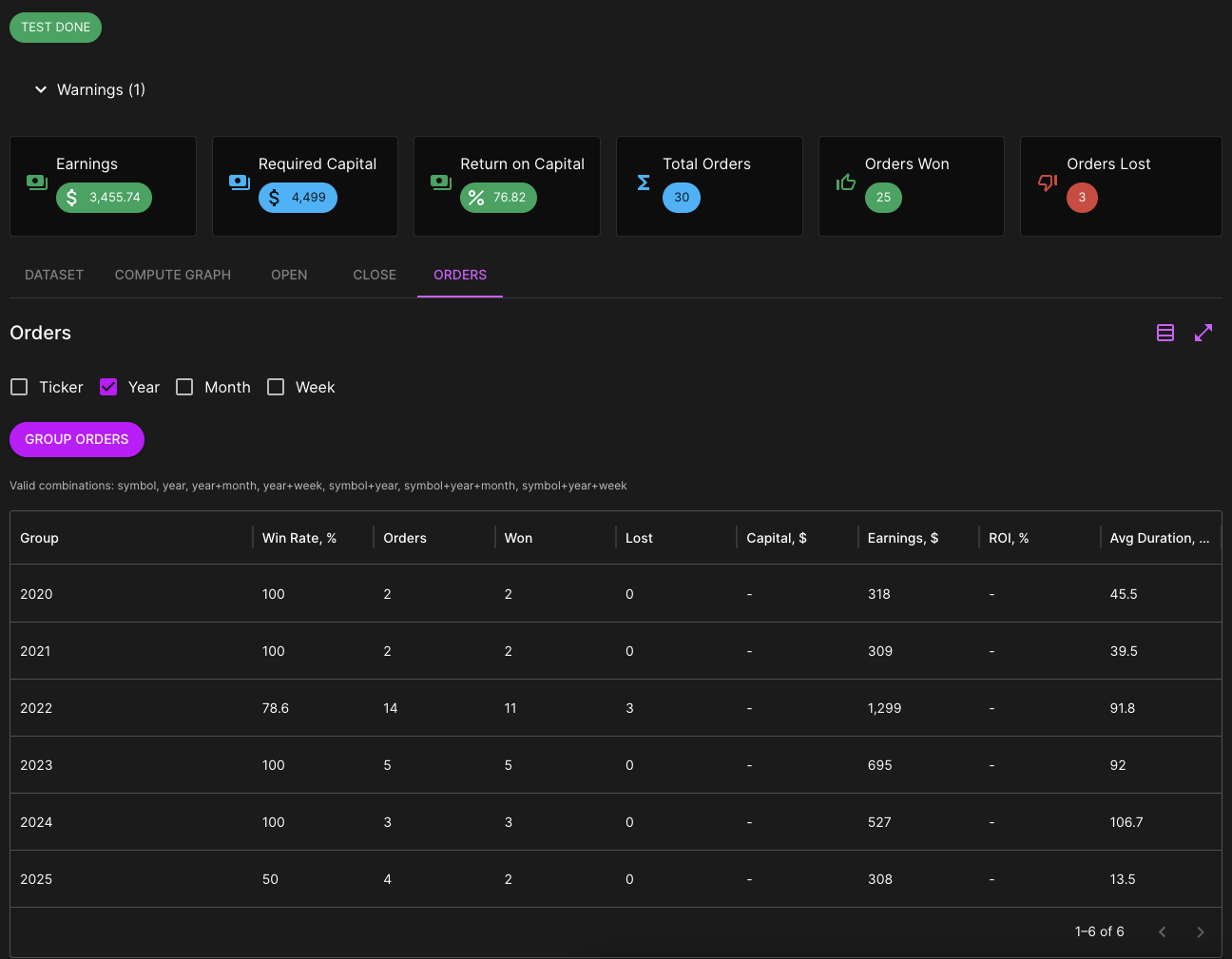

The results on AAPL were completely astounding! 76% ROI, 83% winrate.

Scaling

Someone will say, "30 orders in 6 years? That's overfitting bullshit!"

For me, it's a starting point.

A magnet that MAY attract other needles from the haystack of US stocks.

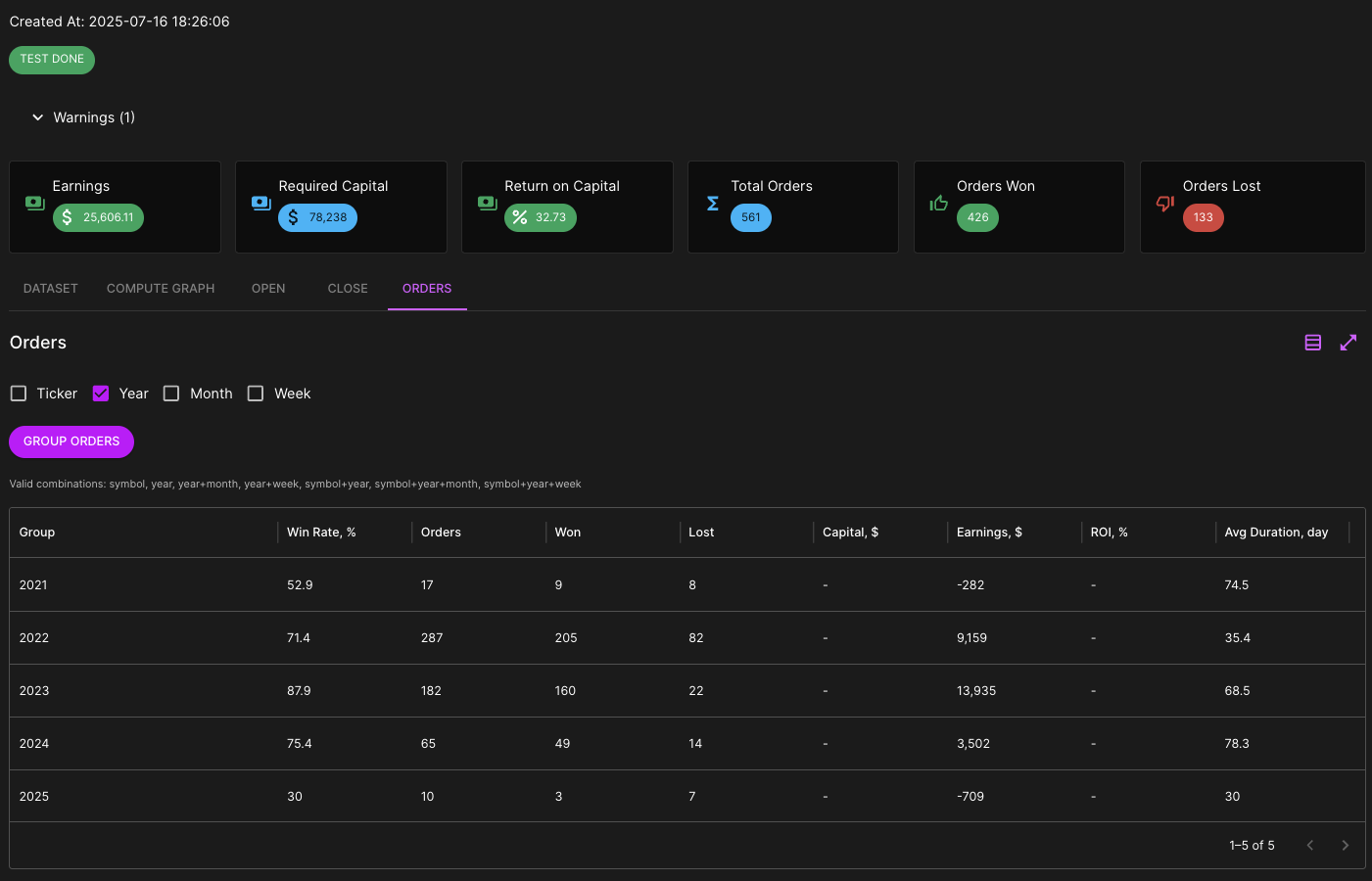

I tested this setup across all major US stocks over 5 years of daily data.

My best result by evening: 32% ROI, 76% winrate, 561 order -> One order per two trading days on average.

Reflection

32% ROI over 5 years doesn't sound like a gold mine, but it's not the point.

The point is I did in one day what used to take me two weeks.

Without a single line of code.

No waiting for data loads or hitting rate limits.

No unrepeatable AI takes.

Plain proven accurate math.

Tomorrow I can start from this and improve further with a speed of 9 ideas per hour.

Or switch my research direction completely and try something else.

The 76% winrate strategy on AAPL

Here's the logic that gives 76% winrate on the last 6 years of AAPL daily data.

Indicator Compute Graph

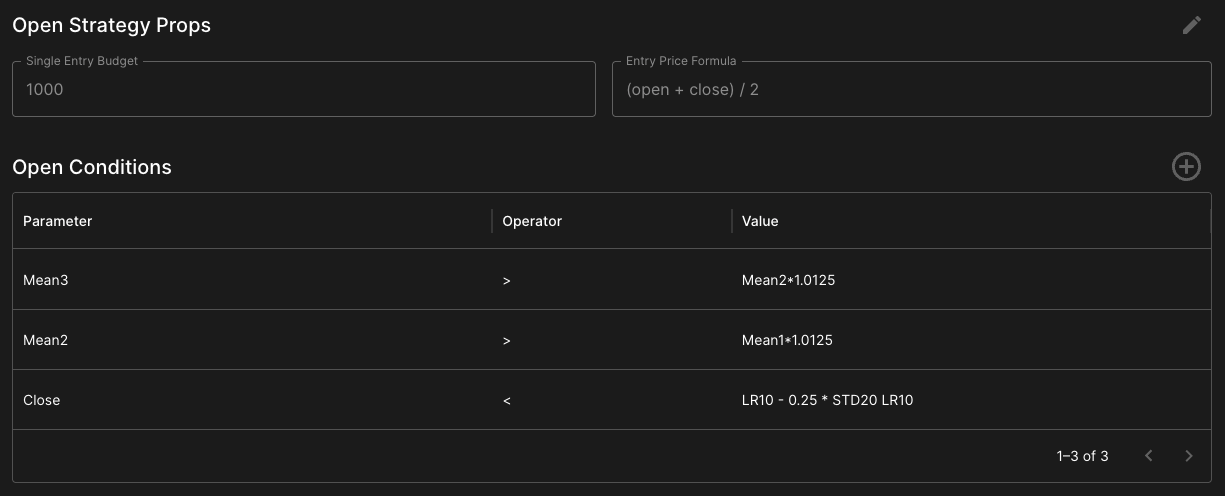

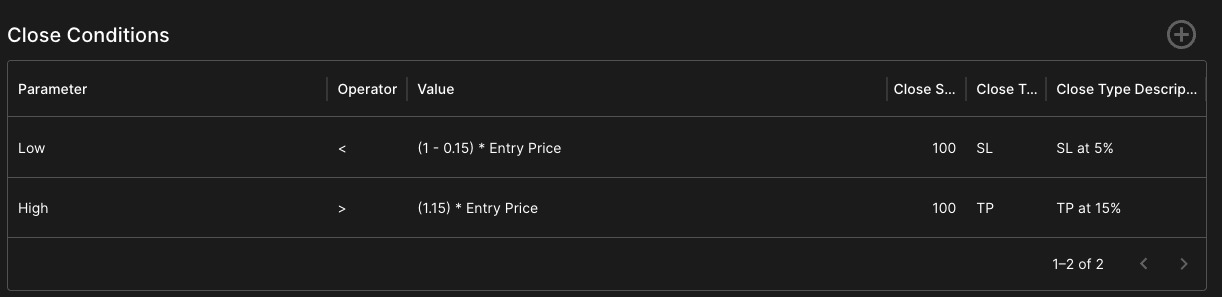

Open and Close Conditions

You can replicate this at profit-signals.com - a platform I built to boost my strategy development efforts.

You can iterate 10x faster with the right tool

Look, I'm the type who needs systems. Numbers calm me down. I love calculated risk.

I know historical performance doesn't guarantee future results. But patterns tend to repeat. E.g., after falls and slowdowns, growth often follows.

If that happened more than 70% of the time in the past, I want to catch those events.

People like me need time to test strategy variants.

Try many, discard most, find something worthwhile.

Test across many tickers to prove it makes sense.

It's like searching a needle in the haystack.

But spending an hour to check a single trading idea with existing code-based frameworks does not sound appealing, so I built a no-code platform that boosts my backtesting speed to at least 9 ideas per hour.

This is the 10x booster I was missing. Want to try? Join me at profit-signals.com.